The CARES Act is necessary to particular innovation companies since it offers essential financial alleviation throughout this unprecedented time. Understanding the available car loans and also gives, tax stipulations, as well as work factors to consider readily available under the CARES Act might have an incredible effect on technology-related companies as they make business-critical choices concerning their workforces and the continuation of their services.

For purposes of Families First Coronavirus Response Act (FFCRA), business count all workers since the moment the FFCRA associated leave is being asked for, including full-time as well as part-time staff members, workers off duty, temporary workers, as well as those workers who are collectively utilized with one more employer or considered part of the "solitary integrated employer."

The FFCRA does not need the employee's permanent home to be in the USA for objectives of checking. a trusted Bay Area employment attorneyRegular with the needs of IRS Notice 2020-54, employers will be called for to report competent ill and household leave wages paid to workers pursuant to the terms of FFCRA either on Form W-2, Box 14, or in a statement provided the Kind W-2.

How Your Small Business Can Benefit From The Cares Act

Under no circumstances may PPP funds be utilized to support non-U.S. employees or procedures. The debtor is in charge of this evaluation and should license that it is eligible to get a PPP funding, including that it has used the appropriate association regulations.

Applicants need to make use of the details provided by the SBA as they examine whether they have associates that should be included in their number of staff members reported on SBA Kind 2483. Along with applying suitable association policies, all customers, specifically innovation organizations that are part of a personal equity or hedge fund investment portfolio, need to take essential steps to guarantee the precision of the certification stated in the Consumer Application stating that "present financial unpredictability makes the financing demand essential to sustain the recurring operations of the candidate." The association rules are forgoed for PPP for organizations in the Lodging and also Resort Code 72, specific franchises, and also specific business issues that receive economic help from a company licensed under area 301 of the Local Business Financial Investment Act.

What Small Businesses Should Know About The Cares Act

Lenders may rely upon a borrower's certification concerning the requirement of the loan request. Any consumer that requested a PPP car loan before the issuance of this advice and settles the loan completely by May 18, 2020 will certainly be deemed by SBA to have made the needed certification in good confidence.

In Frequently Asked Question issued on May 5, 2020, the SBA specified that its affiliation rules at 13 C.F.R. 121. 301(f) apply when it come to counting the workers of international as well as U.S. associates. Especially, it said that: "For purposes of the PPP's 500 or fewer staff member dimension standard, an applicant must count every one of its employees and also the employees of its UNITED STATE

If the candidate is a startup, the applicant's monetary projections should reveal that more than 50% of the candidate's earnings will be stemmed from transients who stay for thirty days or less at once. Services that are licensed as assisted living home or aided living centers as well as give healthcare and/or clinical services.

Cares Act: Impacts And Benefits For Businesses

No collateral or individual guarantees are called for. There is a 6 month deferment on payment. The rates of interest is 1%, and there is a 2 year maturity. Just one financing per service is permitted, this means that a business need to think about looking for the optimum quantity. E-signature and e-consent can be utilized.

On May 13, 2020, the Interim Final Policy Finance Boosts was provided, offering that a collaboration that got a PPP funding that only consisted of amounts required for payroll costs of the collaboration's staff members as well as various other eligible operating costs, yet did not consist of any type of amount for companion settlement, would be eligible to have the loan boosted to include appropriate companion payment. Finances under the program are qualified for mercy to the extent the funds are used to cover pay-roll prices, rent out settlements, utility costs, or home loan interest payments for the duration beginning on the day of the source of the financing and upright the earlier of 24 weeks after the date of origination or December 31, 2020.

Impact Of The Cares Act On Small Businesses

On a proportional basis, at least 60% of the lending mercy amount need to be utilized for pay-roll costs as well as not even more than 40% of such amount may be used for non-payroll things. Lenders are keeping track of this, they want the car loans to be totally forgiven. Loan forgiveness will certainly be decreased to the degree that funding receivers decrease their permanent staff member headcount or employee salaries and also earnings by even more than 25%.

|

Cares Act: Impacts And Benefits For Businesses

To better make sure PPP fundings are restricted to qualified debtors in requirement, the SBA has actually chosen, in appointment with the Department of the Treasury, that it will review all loans over of $2 million, in enhancement to various other loans as ideal, adhering to the lender's submission of the debtor's lending mercy application.

Notably, consumers with finances higher than $2 million that do not please this secure harbor might still have an adequate basis for making the needed good-faith qualification, based on their specific conditions taking into account the language of the certification as well as SBA support.

Since June 12, 2020, the certifications specified in the SBA Borrower Application Type are: Applicant has actually checked out the statements included in this [application], including the Statements Needed by Law as well as Exec Orders, and also comprehends them. Candidate is eligible to receive a lending under the rules in impact at the time this application is sent that have been released by the Small Business Administration (SBA) applying the Paycheck Security Program under Division A, Title I of the Coronavirus Help, Relief, and Economic Safety Act (CARES Act).

The Small Business Owner's Guide To The Cares Act

Candidate will comply, whenever applicable, with the civil legal rights as well as various other limitations in this type. All SBA financing profits will be utilized just for business-related purposes as specified in the lending application and consistent with the Paycheck Protection Program Rule. To the degree viable, Applicant will certainly acquire just American-made equipment and products.

Intersects with the PPP, in that a superior EIDL made use of for payroll expenses made between January 31, 2020, and also April 3, 2020, much less the amount of an advance is included to a PPP loan calculation. If the EIDL funds were not made use of for payroll prices, it does not impact eligibility for a PPP funding.

Impact Of The Cares Act On Small Businesses

The Act provides a refundable payroll tax credit scores for 50% of incomes paid by eligible employers to particular staff members. In order to be an "eligible employer," the taxpayer should have had its operations completely or partially put on hold by government activity, or experienced an above 50% decrease in quarterly invoices (as measured on a year-over-year basis).

This credit rating is not readily available relative to any employee permitted a Work Possibility Credit History under Code Area 21. Delay of Company Payroll Tax Obligation Repayments 2302 allows taxpayers to defer settlement of the employer section of particular pay-roll tax obligations with completion of 2020. Those pay-roll tax obligations consist of Social Security taxes.

Although this takes longer for businesses to realize the savings, it is a web win. Services must note, nonetheless, that this stipulation sundowns starting in 2022. Under the CARES Act, organizations are allowed to defer repayment of the employer's share of Social Safety taxes with the end of 2020. Organizations delaying payroll taxes under this provision are allowed to share of the deferred amount by the end of 2021 and the continuing to be half by the end of 2022.

What The Cares Act Means For Us Businesses

So somehow, you can view this as a short-term interest-free loan from the government. The CARES Act creates a brand-new, briefly refundable payroll tax obligation debt for "qualified employers" affected by COVID-19. A qualified employer is an entity (1) whose procedure is totally or partly suspended in action to governmental orders restricting business, travel, or group meetings or (2) that has actually experienced a considerable decrease in gross invoices, defined as a decline of 50% or even more in quarterly receipts when compared to the previous year quarter. The credit rating is not available to those employers getting PPP financings.

The grant will appear to the candidate three days after the date of approval, as well as does not need to be paid off so long as these funds are made use of for: Supplying paid authorized leave to staff members incapable to work because of the direct effect of the COVID-19 pandemic, Preserving pay-roll to preserve employees during organization disturbances or considerable stagnations, Satisfying boosted expenses to obtain products unavailable from the candidate's original source as a result of disrupted supply chains, Making lease or home mortgage payments, Settling obligations that can not be met due to revenue losses as a result of COVID-19 pandemic.

|

Guide To The Cares Act

Effective applicants will certainly owe absolutely nothing for 6 months and also will certainly then begin making fixed repayments at a below market rate of interest price for the rest of a five-year lending term. Local business of up to 50 workers have the opportunity to companion with their city governments to get grants of approximately $25,000 in functioning resources.

small companies (defined as earning much less than $3 million a year as well as fewer than 50 employees) can get up to $50,000 low-interest fundings if they have actually experienced at the very least a 25% decline in revenue as a result of the coronavirus episode. The North Country Alliance is providing to $25,000 in 5% rate of interest loans to local business influenced by the coronavirus pandemic. As a country, we are still in the middle of the present public wellness dilemma, however additional economic alleviation is on the means.

Cares Act: Implications For Businesses

As pointed out over, under the SBA Calamity Lending Program, businesses are no more required to reveal that they have actually been proactively running for a complete year in order to be eligible to obtain a car loan. Rather, they just require to have functioned since at the very least January 31st, 2020.

Since the President signed the Act right into regulation, the Local business Management (the "SBA") and also United States Treasury Division have actually subsequently issued regulations to clarify which local business may be offered for such relief under the CARES Act. Furthermore, with the news on April 16 that the PPP funds have actually been worn down, customers as well as lending institutions are turning their focus to the Key Street Lending Program.

Organizations whose size-standard is based upon annual receipts in millions of bucks are generally in the farming, building and construction, retail as well as money or insurance policy markets, to name a few. The optimum enabled bucks for companies in these industries can differ extensively relying on the sector, with the range being anywhere in between $1 million and also $41.

Cares Act Assistance For Businesses

The SBA considers "staff members" to be all people employed on a full-time, part-time, or other basis, so long as that private functions a minimum of 40 hrs per month. Because of this, under these affiliation policies, it might be hard for exclusive equity funded profile firms to fulfill the applicable dimension standards in order to get approved for PPP fundings. Nonetheless, the CARES Act forgoes the association requirement for some applicants.

What various other standards must an entity fulfill to be qualified? Candidates do not need to have a minimal credit rating score or reveal a capacity to pay off the PPP financings. Nonetheless, applicants for PPP car loans should meticulously evaluate the eligibility criteria under the Act as well as the standards issued by the SBA and the Treasury Division as each candidate should certify its qualification on a Customer Application in order to be accepted for a PPP lending.

Guide To The Coronavirus Aid, Relief, And Economic Security Act

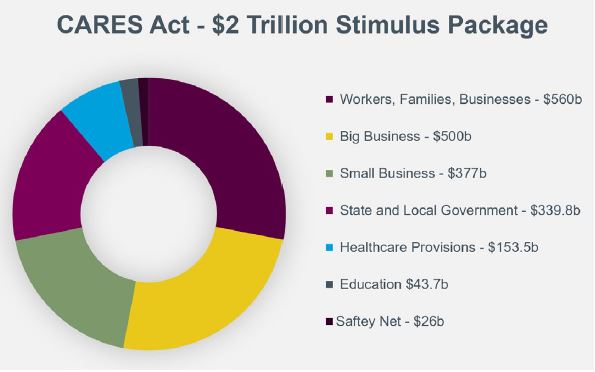

In March, the UNITED STATE federal government authorized into law a $2 trillion relief act focused on providing alleviation to people, services, as well as federal government organizations. If you've been struck hard by the effects of COVID-19, alleviation is right here with the death of The Coronavirus Help, Alleviation, and also Economic Security (CARES) Act.